Trade to trade car marketplace

Trade-only marketplace

Flexible selling options

Maximise your profits

Looking to buy a car at auction in the UK? This guide breaks down everything you need to know, from how auctions work to the smartest strategies traders use to find real bargains. Avoid costly mistakes, learn the insider tips and start bidding like a seasoned pro.

Last updated: 7th August, 2025

Listen to this story

Buying cars at auction can be one of the most efficient ways to source stock as a trader or find a good deal as an individual buyer. It offers speed, variety and (if you know what you’re doing) profit.

But auction buying isn’t as simple as raising a paddle and hoping for the best. It’s a fast-paced environment where preparation, timing, and confidence make all the difference.

In this guide, we’ll walk you through how car auctions work in the UK, how to avoid costly mistakes, and what pro-level buyers do to win quality vehicles at the right price.

A car auction is a marketplace where vehicles are sold to the highest bidder. In the UK, auctions are used by dealers, finance companies, fleets and individuals to buy or offload stock quickly, often at below-retail prices.

There’s more than one kind of car auction in the UK. Knowing which ones to focus on can help you find better stock—and better margins.

Public auctions are open to everyone. You’ll often find part-ex vehicles, ex-lease stock, and seized cars. The variety is high, but so is the competition; everyone from expert traders to hobbyists and first-time buyers is involved. Prices can be unpredictable.

Trade auctions are restricted to motor traders with a valid trade account. These auctions typically offer fresher stock, less emotional bidding, and access to fleet disposals or manufacturer returns. It’s where the pros go to buy.

Online auctions dominate the UK trade scene now. Platforms like Trader.co.uk, BCA and Manheim let you browse, inspect reports and bid from anywhere. Listings come with condition grades, imagery, and digital paperwork, though you won’t always see the car in person.

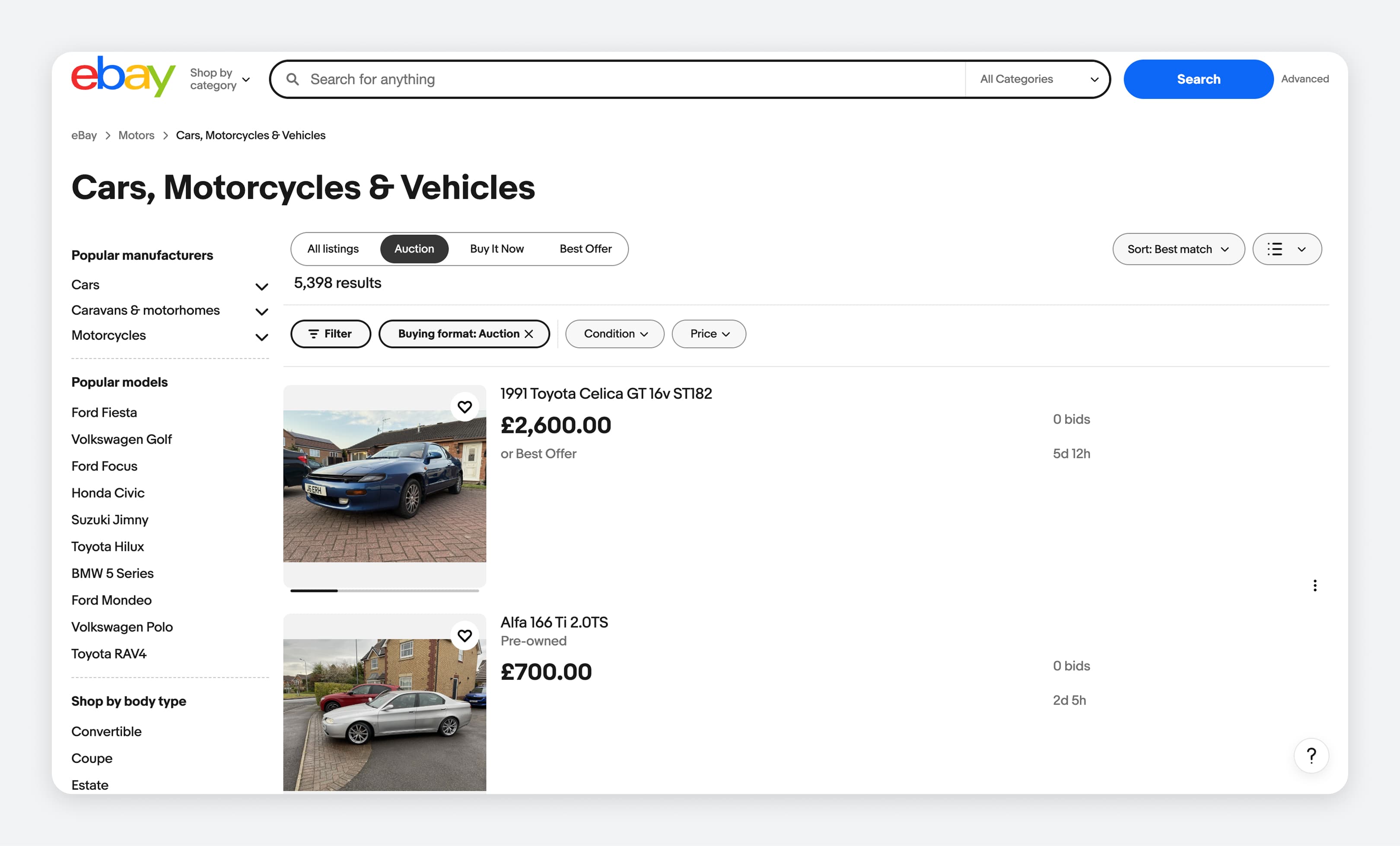

eBay Motors is a bit different because it’s more of a hybrid between auction and marketplace. It’s open to the public, often used for private sales, and can be a place to snag niche vehicles or fixer-uppers if you know what to look for.

These auctions list impounded, seized, or decommissioned vehicles from police forces and government departments. Cars here can be cheap, but they’re sold as seen—with limited history or paperwork. For traders with mechanical know-how or appetite for risk, they can offer high upside.

Salvage auctions (e.g., Trader.co.uk, Copart, Synetiq) sell insurance write-offs—vehicles that have been damaged, stolen-recovered, or declared a total loss. Categories range from light cosmetic damage (Category N) to structural repair cases (Category S). These auctions are for experienced buyers who know how to assess repair costs, resell value, and compliance rules.

Here’s a step-by-step of what happens when you buy at auction:

Each auction house provides a listing for every vehicle going under the hammer. You’ll usually get the make, model, registration year, mileage, MOT status, service history (if available), and a condition grade. Online platforms like BCA and Manheim also include detailed photos, mechanical reports, and vehicle documentation so you can assess before bidding.

In-person bidding is fast-paced and high-energy. You’re competing in real time with others in the room, and it’s easier to read the room or spot when someone’s backing off.

Online bidding is quieter but riskier. You don’t see the vehicle, and bids may come in at the last second. Some platforms run live-streamed auctions, while others use timed bidding with countdown clocks.

Auction houses don’t make money just from the sale price. They charge buyer premiums on top. This is usually a fixed fee or a percentage of the final price (£150 to £500+ depending on the value of the car). Some auctions also charge admin or online convenience fees.

Always factor these in when calculating your true cost because what looks like a bargain can quickly become less attractive once fees are added.

In 2025, buying a car at auction is still one of the most efficient and cost-effective ways for UK traders to source stock. Whether you're flipping vehicles or building a retail forecourt, auctions offer unmatched access to volume, variety and margins you won’t find on the open market.

There are tons of benefits to buying a car at an auction:

That said, auctions aren’t risk-free. Vehicles are sold as seen, and you often can’t test drive or inspect them beyond the exterior. Some cars have limited or no history. If you’re not confident in assessing value or spotting potential issues, you could end up with a costly mistake instead of a great deal.

To simplify the pros and cons of auctions versus traditional car buying, we’ve prepared a table comparing the two:

| Factor | Car auction | Traditional dealer or private sale |

|---|---|---|

| Price | Often lower than market | Higher; includes dealer margin |

| Speed | Very fast—same-day purchases possible | Slower; negotiation, paperwork, etc. |

| Choice | Huge volume across all segments | Limited to seller stock |

| Risk level | Higher; ‘sold as seen’, no test drives | Lower; warranties or return rights possible |

| Vehicle history | Sometimes limited or missing | More likely to be complete |

| Inspection time | Short or none | Full inspections/test drives possible |

| Fees | Buyer premiums, admin fees apply | Usually no extra fees beyond sale price |

Buying a car at auction as a non-trader can be a good idea, but only if you go in with your eyes wide open. If…

…then it can be worth it.

But it’s not for everyone. Individual buyers don’t have the same tools or fallback options dealers do. You won’t get a warranty, refund rights or often even a test drive. You’re also competing with professionals who bid for a living and know how to spot value (or avoid a lemon). If you’re not careful, you might overpay or wind up with unexpected repair bills.

Car auctions in the UK attract a wide mix of vehicles—from nearly-new fleet returns to damaged write-offs and vintage collectibles. Knowing what’s on offer helps you target the right stock for your buyers and budget.

These are company cars or lease vehicles returned at the end of a contract, usually after 2 to 4 years. Expect well-maintained vehicles with full service histories, consistent MOTs, and higher mileages. They often come from known sources like finance companies or leasing firms and aren’t very old, so you can bid with more confidence.

Repo’ed cars are taken back by finance companies due to missed payments. Condition varies, with some barely used and others badly neglected. There’s often no paperwork or service record, but the prices can be aggressive. And there is risk: if someone wasn’t making payments on the car, why would you assume they’re taking good care of it?

Ex-government vehicles come from police departments, councils, or other public bodies. They’re usually well-serviced but plain-spec and high mileage. Still, they offer strong value for the right buyer.

While salvage titles sound bad, an insurance company declares a car a write-off simply because it’s not financially worth it for them to fix it. In the case of Cat N and Cat S cars, that means they’re still repairable (and possibly profitable).

Salvage auctions on Trader.co.uk are packed with these vehicles. If you’ve got access to low-cost repairs or bodywork, they can be highly profitable. And as a buyer, snapping up a salvage car with excellent repair work means you’re getting a fantastic deal compared to the clean-title equivalent.

Specialist auctions include vintage, rare and enthusiast models. These might be low-mileage gems, restoration projects or classic cars with historical value. For instance, if you wanted to find a Ferrari 250 GT SWB from the early 1960s, an auction would be your best bet.

Prices can swing wildly depending on demand. They also depend on how much the individual participants want the car. One rich guy who really wants it could jack the price up by tens or hundreds of thousands if it’s a particularly sought-after model.

If you know your niche or have collector clients, these sales can be goldmines.

Bidding at auction can move fast. Sometimes, too fast. If you don’t do your homework beforehand, you’re going to be buying blind. The best traders dig deeper than the information they’re given.

Anthony Sharkey is COO at New Reg Limited (Car.co.uk, Trader.co.uk, Garage.co.uk), driving innovation in vehicle recycling, logistics, and customer experience.

The biggest mistake new buyers make at auction is rushing in without knowing the full scope of what they’re bidding on. You wouldn’t buy a house without preliminary checks, and the same logic applies to cars. Always do your verifications, understand what you're bidding on and how much it’s worth and factor in the true total cost. Auctions are brilliant for finding value, but only if you treat every bid like a business decision.

Never assume the auction house has done this for you. Always run an HPI Check to confirm:

Many auction platforms partner with HPI and provide this info, but it’s worth double-checking yourself, especially if something feels off. It’s only £10 to £30 and can seriously save you from buying something that’s not worth what others are offering.

If you’re attending a physical auction, get there early and walk the yard. Look for:

Most auctions don’t allow test drives, so this is your only chance to spot red flags.

Auction catalogues use shorthand, so you’re going to have to get familiar with it. Terms like “engine runs” or “drives through gears” don’t mean the car is perfect. They simply mean it starts or moves.

A few you’ll see almost everywhere:

If a listing seems vague or overly positive, proceed with caution. The best traders know how to read between the lines.

Winning the bid is only part of the story. When you buy a car at auction in the UK, there are several extra costs on top of the hammer price. As a first-time buyer, it’s important to understand these upfront so you don’t blow your budget or get caught out.

Every auction house charges a buyer’s premium. This is their cut for handling the sale. It’s usually a flat fee (e.g., £150 to £300 per vehicle) or a percentage based on the final price.

Some also charge an admin fee on top, or combine it with the premium. These fees aren’t negotiable, and they apply whether you’re a trader or private buyer. Always check the auction house’s fee structure in advance because it’s often hidden in the small print.

Example: You win a car for £4,000. The buyer’s premium is 10%. Your total is now £4,400 before any other costs.

Not every car at auction includes VAT, but when it does, it makes a big difference.

You’ll usually see one of the following labels:

If you're a private buyer, you’ll still have to pay the VAT, but you can’t reclaim it. So a £5,000 bid becomes £6,000 with VAT added.

You can’t drive most auction purchases away immediately. This is especially true if the car has no valid MOT, it’s SORN’d or unregistered or it’s a salvage or repairable vehicle.

You’ll either need to hire a trade plate driver, book a recovery truck or flatbed or arrange delivery through the auction house (many offer this for a fee).

Transport costs vary depending on distance, vehicle type, and urgency, but we advise you to budget anywhere from £100 to £300.

Once the car is yours, it’s your responsibility to get it road-legal:

Also consider insurance, which you’ll need it in place before driving the car anywhere.

Once you’re ready to dive into the auction world, it really pays to know where to go. The UK has a solid mix of national giants, regional specialists, and niche platforms, each offering something a little different depending on what you’re after.

Trader.co.uk is a closed marketplace built specifically for verified motor traders. Once approved, you get access to a constant stream of under-the-radar vehicles: MOT failures, non-runners, damaged cars, ageing stock and even high-mileage units.

No middlemen, no inflated markups, just direct access to stock from MOT stations, garages, and trusted independent sellers.

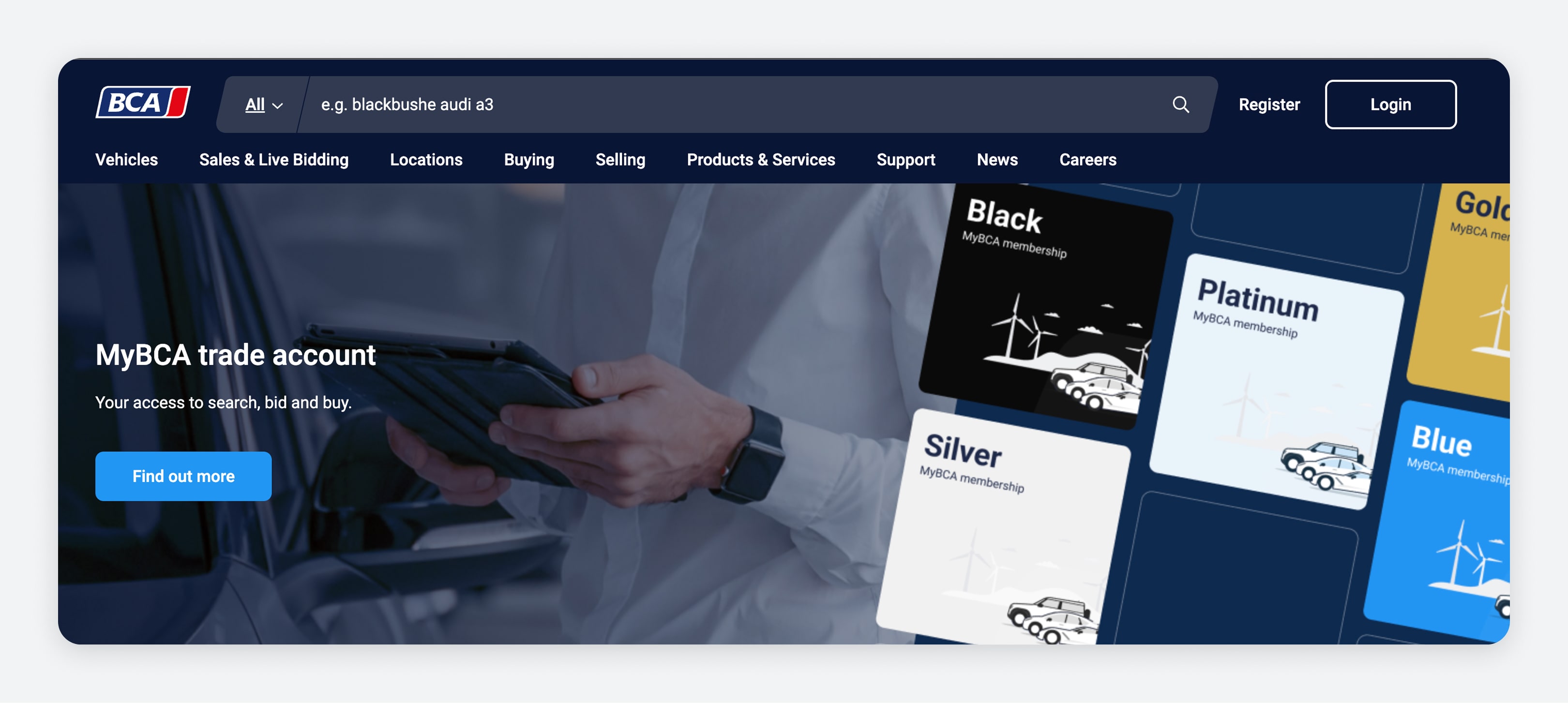

BCA is the UK’s largest car auction group, offering everything from ex-lease vehicles to prestige cars. You’ll find daily online sales, slick buyer tools, condition grades and thousands of listings across all categories.

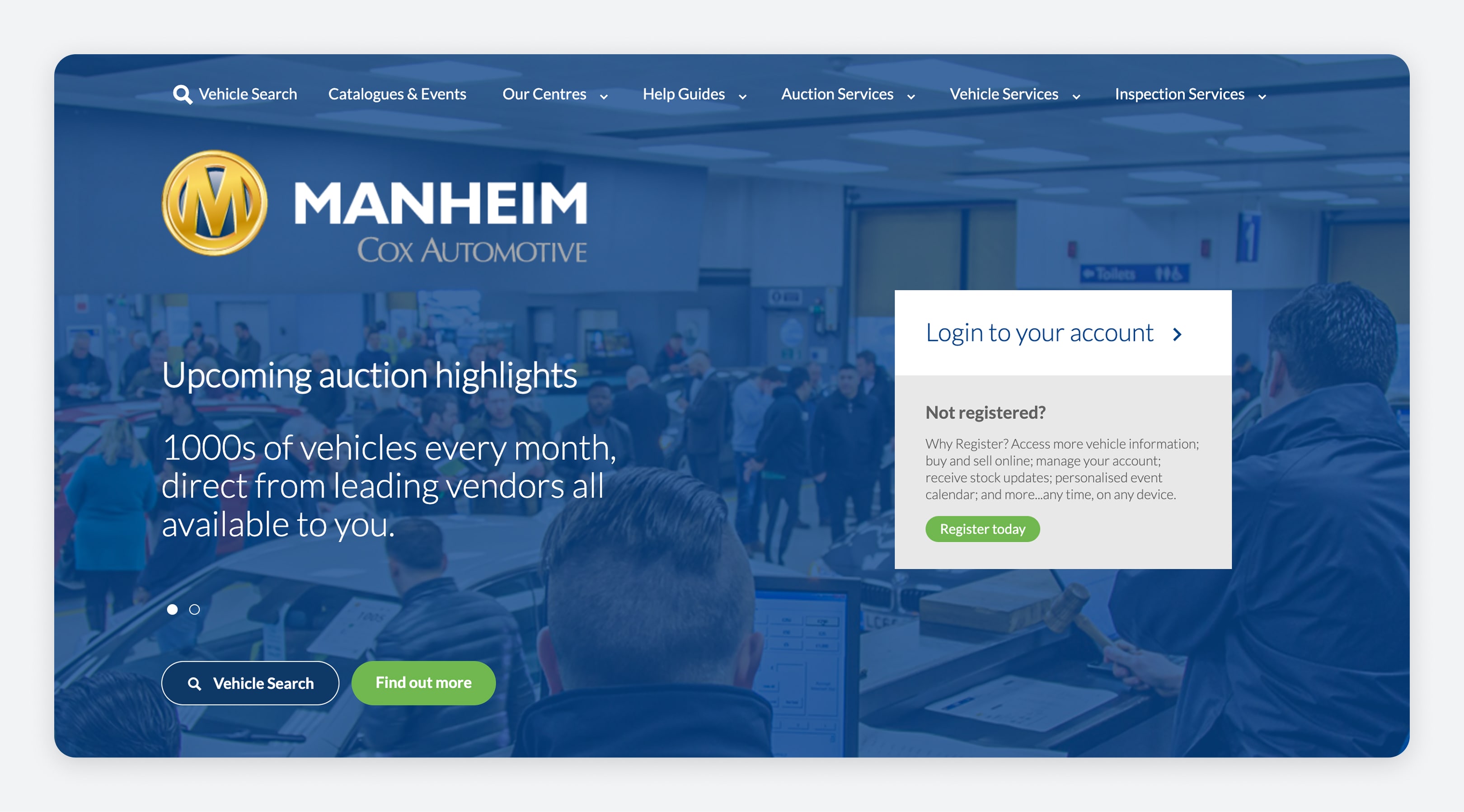

Manheim focuses heavily on dealer stock, fleet returns and nearly-new vehicles. It’s a go-to for traders looking for clean, well-documented cars. Their platform is polished and full of data.

Unlike the big auction houses, eBay Motors is a hybrid — part classified, part timed auction. It’s open to everyone and great for spotting unusual cars, project vehicles, or cheap runarounds. Just remember, quality and reliability vary.

Copart is the UK’s leading salvage auction platform, offering Category S/N and damaged stock from insurers. It’s used by traders, garages and DIY mechanics alike. Know your repair costs before bidding if you want to get a profitable deal.

With several auction centres across England, Aston Barclay is known for clean presentation, well-described vehicles and strong relationships with fleets and finance providers. Their digital platform is user-friendly and trader-focused, though there are plenty of fleet and finance vehicles auctioned off to the general public.

Wilsons holds more than 3,200 auctions every year. They’ve got everything from from standard cars to vans, 4×4s, lorries, trailers and seized asset stock. It’s a mixed bag, but some great bargains are possible if you know what to look for.

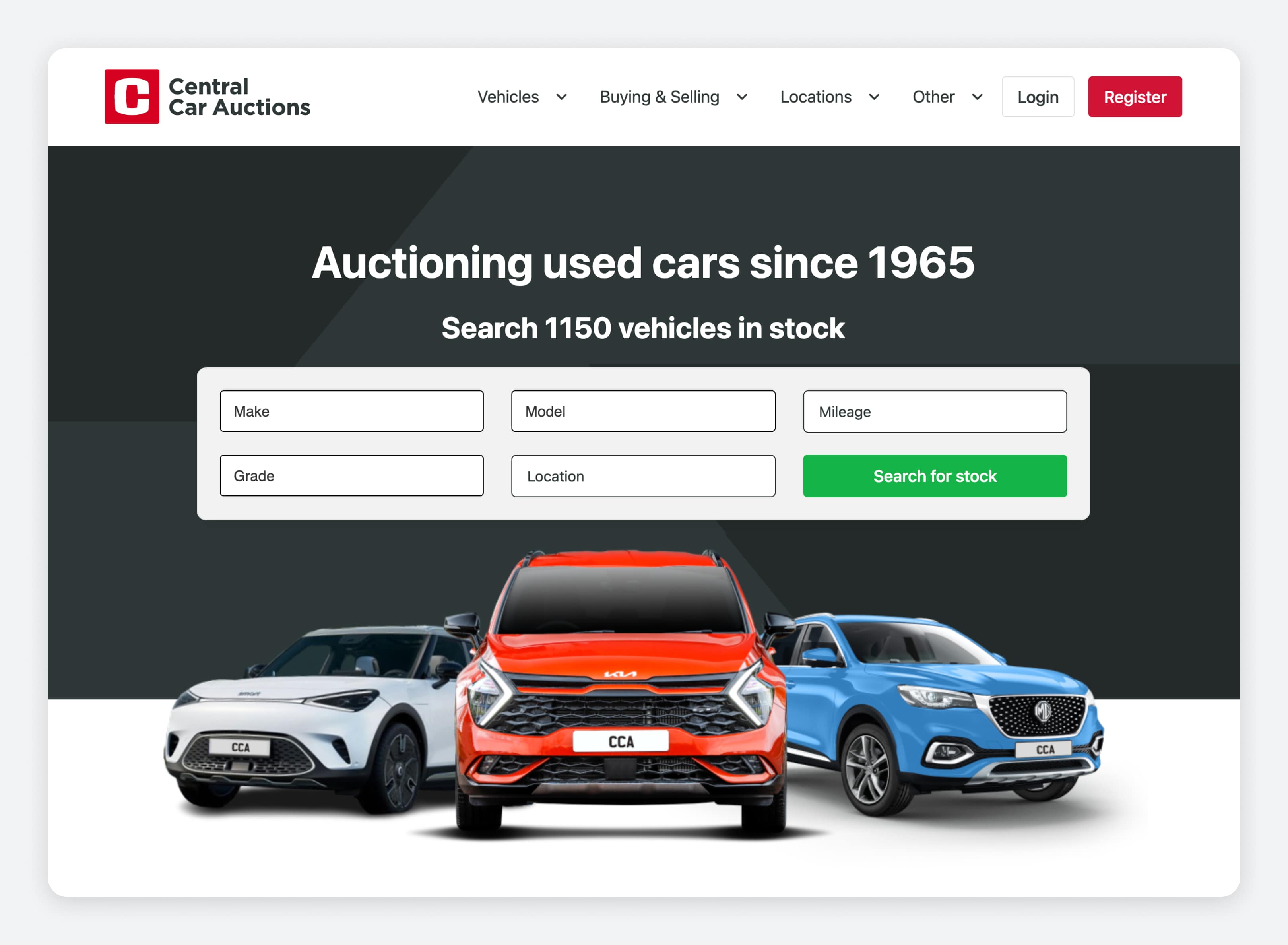

Based in Glasgow, Central Car Auctions is one of Scotland’s largest, with live-streamed bidding and regular stock turnover. They serve both the public and trade and offer everything from part-ex to ex-fleet.

Even seasoned traders can make costly mistakes at auction. For first-time buyers, these slip-ups are even more likely (but no less avoidable). Knowing what to watch out for and how to handle it will save you time, stress, and serious money.

It’s easy to get caught up in a bidding war when you’ve invested time researching a car and feel emotionally committed. But remember: auctions are business, not personal.

Some auction cars are insurance write-offs. If you don’t understand the category system, you might buy a car with hidden history—or worse, a resale nightmare.

Remember the categories:

Some auction cars don’t come with a V5C logbook. That makes it harder to tax, sell and prove ownership. It also creates more work for you, the buyer, because you’ll be the one responsible for sorting that out.

Most reputable auction houses are safe, but scams still happen. They’re even more common on open marketplaces like eBay.

What you do next matters just as much as the bidding itself. Here’s how to handle the post-auction process properly, so you stay legal and protect your investment.

Auction houses expect fast payment. Usually, it’s within 24 to 48 hours of the sale. Accepted methods typically include bank transfer, debit card, or online payment through your account dashboard. Some auctions charge late payment fees, so don’t delay.

Pro tip: Confirm whether fees (buyer’s premium, VAT, admin charges) are included in the invoice total before paying. Many will itemise so you can see this clearly.

Once payment clears, you’ll get instructions to collect the vehicle. If it’s roadworthy, insured and taxed, you can drive it away. If not, you’ll need a transporter or trade plate driver. Some auction houses offer delivery for an added fee. It’s convenient and sometimes cheaper than arranging it yourself.

For insurance cover, quite a few providers offer temporary cover for newly purchased vehicles. You can use this while you shop around for a better deal on more permanent coverage.

Make sure the seller (or auction house) logs the change of ownership with DVLA and that you receive the “new keeper” slip. You’ll need this to tax and insure the vehicle while the DVLA is processing the change and sending you the updated logbook.

Driving without tax or insurance is illegal, even if you just bought the car. Before driving the car home or putting it on the road:

If needed, book an MOT (you can legally drive to a pre-booked MOT test, but nowhere else).

Even if you checked the car beforehand, give it a proper look once it’s yours. Check fluid levels, tyre condition, warning lights, battery health, and brakes. If it’s going straight to resale, get it professionally cleaned and serviced to maximise the value.

At Trader, we’ve all been in the car trade for decades now. But trust us when we say we still remember our first few auctions like they were yesterday. Exciting, nerve-wracking and full of lessons I wish someone had told me beforehand.

If you're new to buying at auction, here are the hard-earned tips that could save you thousands:

When you’re starting out, you’re probably thinking you just have to focus on the bid. Wrong. The real cost of a car at auction is the sum of everything after the hammer falls.

Here’s how our team budget smart, like a pro:

The golden rule is that if you don’t know your margin before you bid, you’re essentially gambling, not trading.

Looking back, I made every rookie mistake you can imagine. If I were starting again today, I’d:

Starting slow and steady will get you much further than swinging big from day one.

Want to know where seasoned traders keep going back to? Here are the auction houses I still rate highly in 2025:

But here's the truth: the best place to buy isn’t a specific auction, it’s the one you understand inside-out. Know how their grading works. Know their fee structure. Know when their best stock runs.

If you understand the process, know how to read listings, and set firm limits, you can uncover serious value whether you're flipping stock, growing your fleet, or even just buying for personal use.

The key? Think like a trader from day one. Do your homework. Don’t rush. And remember: the car you walk away from is sometimes the best buy you’ll ever make.

Yes, plenty of traders and private sellers offload cars through auctions. Whether it's a part-ex you don’t want or a car you've prepped for resale, auctions offer quick turnaround and wide buyer exposure. Just be aware of selling fees and reserve pricing.

Not usually, no. Most auction vehicles can be started and inspected on-site, but you won’t be allowed to drive them. That’s why it’s so important to review condition reports and do a thorough visual check.

You can’t just walk away. Once the hammer falls, the sale is legally binding. If you back out, you’ll face financial penalties, often losing your deposit or being banned from future auctions. Some auction houses may even pursue legal action for breach of contract.

Yes, there are quite a few lenders offer finance specifically for auction purchases. These include trade finance companies, high-street banks, and online platforms. Just make sure your financing is approved before bidding, as payment is usually due within 24 to 48 hours of winning.

It can be. Auctions often offer below-retail prices, especially for high-mileage, ex-fleet or unprepped stock. But you must factor in fees, potential repairs and the lack of warranty, so always calculate your true total cost.

End-of-month and end-of-quarter sales (March, June, September, December) tend to have higher stock volumes as lease returns and fleet disposals flood in. More supply means better deals if you’re selective.

No. All auction sales are final and sold “as seen”. There are no cooling-off rights or returns, even if the car turns out to have issues. That’s why due diligence before bidding is absolutely critical.