Trade to trade car marketplace

Trade-only marketplace

Flexible selling options

Maximise your profits

If you're sitting on a car with a salvage title, you might not be out of luck. Depending on its salvage category, you might be able to sell it as-is, fix and resell it, or part it out. In this article, we’ll show you how to figure out your options (and what your car could be worth).

Last updated: 3rd December, 2025

Listen to this story

Keir Starmer’s government is making major changes to the car tax system. As of April, car tax changes have already taken place, with more upheavals to come in 2026. Some of these changes are big - car owners should take the time to find out how much they need to pay to avoid penalties and budget more effectively.

So, let’s examine Rachel Reeves’ car tax changes. First, we’ll look at the current state of affairs as of April 2025, then we’ll dig into some of the changes set to come in next year, as well as some of the car and road tax changes currently being discussed (which could well be brought in).

Here’s what you need to know about car tax changes in 2025/26.

As well as some slight (and some not-so-slight) increases in car tax rates, there are also some other significant shifts that have taken place. It can seem complicated, but it doesn’t have to be. We’ve got your back!

There are basically four factors that dictate the car tax rate you’ll pay in the UK. They are:

Let’s break it down:

One of the most important factors in your car tax changes is when your car was first registered. This will affect not only how much you pay but also which type of tax you pay.

Here’s a breakdown:

Rachel Reeves’ car tax changes mean that all cars registered after March 1st 2001 will pay car tax based on their CO2 emissions (except cars registered after April 1st 2017 from the second year onwards). However, the rates are different.

We can split this into two categories: cars registered between March 1st 2001 and April 1st 2017, and cars registered after April 1st 2017.

For cars registered between March 1st 2001 and April 1st 2017, the CO2-based tax bands look like this:

| Band | CO2 emission | Petrol car (TC48) and diesel car (TC49) and alternative fuel cars (TC59) (Single 12 month payment) |

|---|---|---|

| A | Up to 100 g/km | £20 |

| B | 101 - 110 g/km | £20 |

| C | 111 - 120 g/km | £35 |

| D | 121 - 130 g/km | £165 |

| E | 131 - 140 g/km | £195 |

| F | 141 - 150 g/km | £215 |

| G | 151 - 165 g/km | £265 |

| H | 166 - 175 g/km | £315 |

| I | 176 - 185 g/km | £345 |

| J | 186 - 200 g/km | £395 |

| K | 201 - 225 g/km | £430 |

| L | 226 - 255 g/km | £735 |

| M | Over 255 g/km | £760 |

The rates are different for cars registered after April 1st 2017. From the second year onwards, they’ll only pay the standard rate of £195. However, the first-year “showroom tax” is based on CO2 emissions, with these bands:

| CO2 emissions | Diesel cars (TC49) that meet the RDE2 standard and petrol cars (TC48) | All other diesel cars (TC49) | Alternative fuel cars (TC59) |

|---|---|---|---|

| 0 g/km | £10 | £10 | £10 |

| 1 - 50 g/km | £110 | £110 | £110 |

| 51 - 75 g/km | £130 | £130 | £130 |

| 76 - 90 g/km | £270 | £350 | £250 |

| 91 - 100 g/km | £350 | £390 | £330 |

| 101 - 110 g/km | £390 | £440 | £370 |

| 111 - 130 g/km | £440 | £540 | £420 |

| 131 - 150 g/km | £540 | £1360 | £520 |

| 151 - 170 g/km | £1360 | £2190 | £1340 |

| 171 - 190 g/km | £2190 | £3300 | £2170 |

| 191 - 225 g/km | £3300 | £4680 | £3280 |

| 226 - 255 g/km | £4680 | £5490 | £4660 |

| Over 255 g/km | £5490 | £5490 | £5490 |

There have been a few company car tax changes to keep an eye on if you either use a company car or provide one.

Essentially, you still pay tax on a company car if you use it privately (which includes commuting). How much you pay is mostly down to the car’s value and its fuel type, like any other vehicle. However, you might be able to pay less if:

The BiK rate on company electric cars has also increased to 3%, although that’s still much lower than it is for other internal combustion engine vehicles.

We recommend regularly checking in with the government’s company car tax updates and using their company car tax calculator for employees.

As we all know, electric vehicles used to be exempt from car tax. That’s changed. As of April 2025, DVLA electric car tax changes mean that owners of electric cars will have to pay car tax. No more exemptions.

The rate depends on the type of vehicle and when it was first registered:

For hybrid and alternatively fuelled vehicles (AFVs), the rates are different:

Don’t forget, for vehicles with a list price of over £40,000 registered on/after April 1st 2025, there’s an additional rate. This is £425.

Award-winning CEO driving growth and social impact across automotive, recycling, and technology-led enterprise platforms.

Drivers should be aware that while almost all drivers will see a slight rise in road tax, EV owners will see the largest increase. After a fair £10 first-year showroom tax, EV owners will have to pay the standard rate of £195. The goal here is to equal out the taxation playing field and make sure everyone chips in as EV adoption rises and CO2 emissions fall.

Rachel Reeves’ car tax changes aren’t over yet. There are more changes coming in 2026 - some set, some proposed.

Let’s take a look:

Electric vehicles are already no longer exempt from car tax. In addition to the standard rate of £195 (for EVs registered between April 2017 and March 2025), owners will also have to pay the £425 Expensive Car Supplement.

This means that even if you have an electric vehicle and are currently paying a lower showroom tax rate (based on CO2 emissions) for the first year, you’ll have to pay the standard rate from the second year onwards.

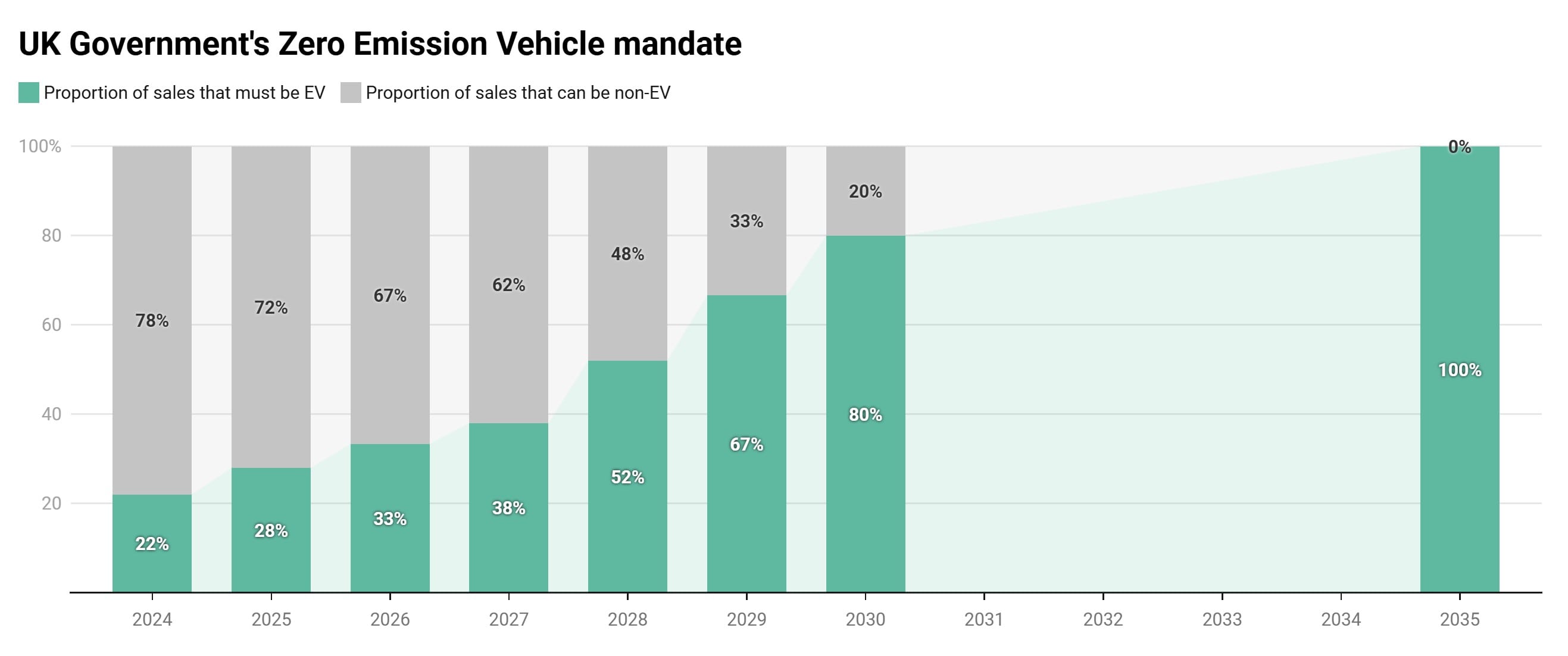

EV adoption is rising in the UK. The government’s own ZEV mandate has a target of making sure 80% of new cars sold are electric by 2030. This should help with Net Zero targets. However, it comes at a cost.

Until now, EVs haven’t been subject to road tax. That means VED income has dropped massively.

One way to counteract this could be pay per mile car tax change. This kind of road pricing system would see drivers pay per mile driven, not based on the vehicle itself. Many organizations suggest this would be a fairer system that could fund road maintenance much more efficiently.

However, while the government may be considering it, there are currently no official plans to implement a new road pricing system.

Get clear, accurate insights on how these car road tax changes, petrol and diesel car tax changes, and electric car tax changes will actually affect you and your wallet below:

In most cases, private owners with petrol or diesel cars will pay more per year on car tax. This could be anything from £10 to £100 more.

For example, car tax for low-emission vehicles used to be £0-£10. It’s now a flat £110. Likewise, the standard rate has risen to £195.

Overall, you’ll likely pay up to £100 more per year on car tax.

There are big changes to be aware of when it comes to electric vehicles. For starters, EV cars are no longer tax-exempt. You will have to pay tax on EVs from 2025 onwards.

How much more you’ll be paying depends on when your car was first registered:

So, the recent tax changes are affecting EV owners the most. Although this first year you won’t pay much, from next year onwards you’ll pay the standard rate.

If the car is worth more than £40,000, you’ll also be charged the £425 Expensive Car Supplement.

The government’s new rules affect both fleet managers and company car drivers.

Electric vehicles remain slightly cheaper to run, but will, from now on, incur tax charges.

For classic car owners, things remain more or less the same. However, it depends on exactly how old the car is.

If your classic vehicle is more than 40 years old (registered before January 1985), you don’t have to pay road tax. The 40-year-rule hasn’t changed.

However, you might still have an older vehicle or even a classic car that’s not yet 40 years old. In which case, new tax rates will apply. How much you pay depends on the size of the vehicle’s engine:

Some have argued that the 2025 car tax changes affect low-income households the most. Those who can afford a £40,000+ car might not “feel” the £425 Expensive Car Supplement the way someone who relies on a 20-year old £2000 car will feel an albeit smaller rise.

That’s especially true for low-income households who might happen to have an electric car. These households will see an almost-£200 rise in annual costs.

In some areas, running a car is simply necessary. For people who live there, the rise in tax could be felt most keenly.

There aren’t any specific car tax changes for older drivers. However, it’s worth noting that older drivers may qualify for full VED exemption because they receive certain qualifying benefits (regardless of age). Those benefits include:

You can apply for these exemptions via the DVLA. Even if you can’t get a full car tax exemption, you might still qualify for a 50% reduction, which can go a long way!

Unfortunately, though, if you don’t receive such benefits, you’ll have to pay car tax at the same rates as younger drivers. How much you pay is based on your vehicle’s age and its CO2 emissions.

2025’s wide-ranging car road tax changes aren’t completely overhauling the car market, but they are causing ripples. Companies, both manufacturers and dealerships, are repricing risk and rethinking stock and contracts. Most notably in the EV market.

Here’s what the changes really mean in certain areas:

The VED changes of 2025 have been a long time coming. They were actually laid out in Jeremy Hunt’s Autumn Statement 2022, although they were brought in by Rachel Reeves in 2025. This shows there’s a general consensus.

The government’s stance on these changes is clear: it’s about making a fairer motor tax system wherein all drivers, not just petrol and diesel car owners, contribute. Labour added the smaller first-year VED charges for electric vehicles as an “incentive” for zero and low-emissions purchases.

However, the changes aren’t without opponents. Many say that the annual £425 Expensive Car Supplement on cars over £40,000 hits a disproportionate amount of EVs, even mid-range models. They argue this could put people off from investing in greener vehicles. Only time will tell if they’re right.

Looking ahead, there are several things UK drivers can do to budget better and get a hold of their taxes.

For a start, we recommend checking your car tax rate as soon as possible. The easiest way to do this is use a free online car tax checker. Simply enter your details and find out your tax rate - no messy spreadsheets, no confusion! With this info, you can plan more effectively.

As for other practical advice, here are some questions to consider:

Older cars could have higher tax costs, depending on how much CO2 they emit, whereas newer, even electric vehicles could cost less in the long-run. However, bear in mind that cars with a list price of over £40,000 are subject to an extra £425 per year for five years!

EV owners should be aware that although they receive a lower first-year tax rate, that rate goes up to the standard rate from the second year onwards.

Rachel Reeves just announced that the next UK annual budget will be released on November 26th 2025. This could bring in updates to car tax changes that would come into effect in April next year. However, we don’t know this for sure yet.

When it comes to confirmed car tax changes that will take place beyond 2025 to 2030, the only thing we know for sure is that Benefit in Kind (BiK) tax rates for electric company cars is due to increase every year (currently on 3%, up from 2%) until 2029/30.

All current tax rates apply to the tax year 2025/26 - beyond that, things could change.

A recent KPMG study suggested that we can likely expect a more integrated road pricing system to be rolled out at some point in the near future. This would address the falling VED income as zero-emission vehicles become more prevalent and make sure everyone, including EV owners, contribute equally.

However, the government currently has no official road pricing pilot in place. Nor has it proposed one. It wants to encourage EV ownership to reach Net Zero targets. However, most agree this would necessitate an entirely new approach to road tax.

To sum up: Rachel Reeves’ car tax changes affect almost all drivers. For drivers of older vehicles, there could be a slight increase in car tax based on CO2 emissions. EV drivers have been hit the hardest. Despite a lower first-year rate which could be as low as £10, from the second year of ownership onwards, they’ll be on the standard £195 rate.

If the vehicle has a list price of more than £40,000, there’s also a new Expensive Car Supplement of £425 per year for the first five years.

BiK rates, currently on 3%, are also due to rise.

Car tax is unlikely to go down in the UK. We can’t be sure what will be in the next budget, but there is widespread acknowledgement that with the rise of zero-emission vehicles and the consequent drop in VED income, there’s fertile ground for a new road tax system.

If your vehicle was first registered after April 2017, you’ll pay a first-year showroom tax based on CO2 emissions. Assuming the vehicle produces zero emissions, this would be £10. From the second year onwards, that rises to £195.

It depends how much CO2 they produce. Emissions-based tax rates for cars registered between 2001 and 2017 are actually lower than the emissions-based tax rates for cars registered after 2017. However, cars registered since 2017 will only pay that tax for one year then switch to the £195 standard rate. In the long-run, you could pay less with a newer vehicle even if it produces more CO2.

BiK rates on hybrid cars are rising, but they’re still much lower than for ICE vehicles. The £10 annual discount has also been scrapped.

As for the 2025 changes, they’re already in place, so no. With regards to future changes, like the annual BiK increase, it’s possible, but unlikely.

There hasn’t been a significant change in used car value since the 2025 car tax changes came in. The biggest car value factors are still age, mileage, cosmetics, and fuel efficiency.

We can’t say for certain, but there’s a lot of momentum behind a potentially fairer road pricing system. Many big organisations are researching it. However, the government has no official plans for a road pricing rollout.

Car tax rates have increased across the board. However, disabled drivers are still eligible for either the 100% or 50% discount, depending on which benefits they receive.